While analysing marketing cases, you must have realised the need to assess the growth of product lines several times. Sometimes, you also must have come across situations where you have to simultaneously determine the growth of more than one product line. BCG growth-share matrix would be your go-to framework for these cases.

Several models can help you assess the growth of product lines; however, the BCG matrix is considered the benchmark model. Let us understand what is the BCG growth-share matrix model and what is the growth-share matrix used for. I will also explain what are the four components of BCG matrix and how do you calculate market growth in BCG matrix.

What is the growth-share matrix used for?

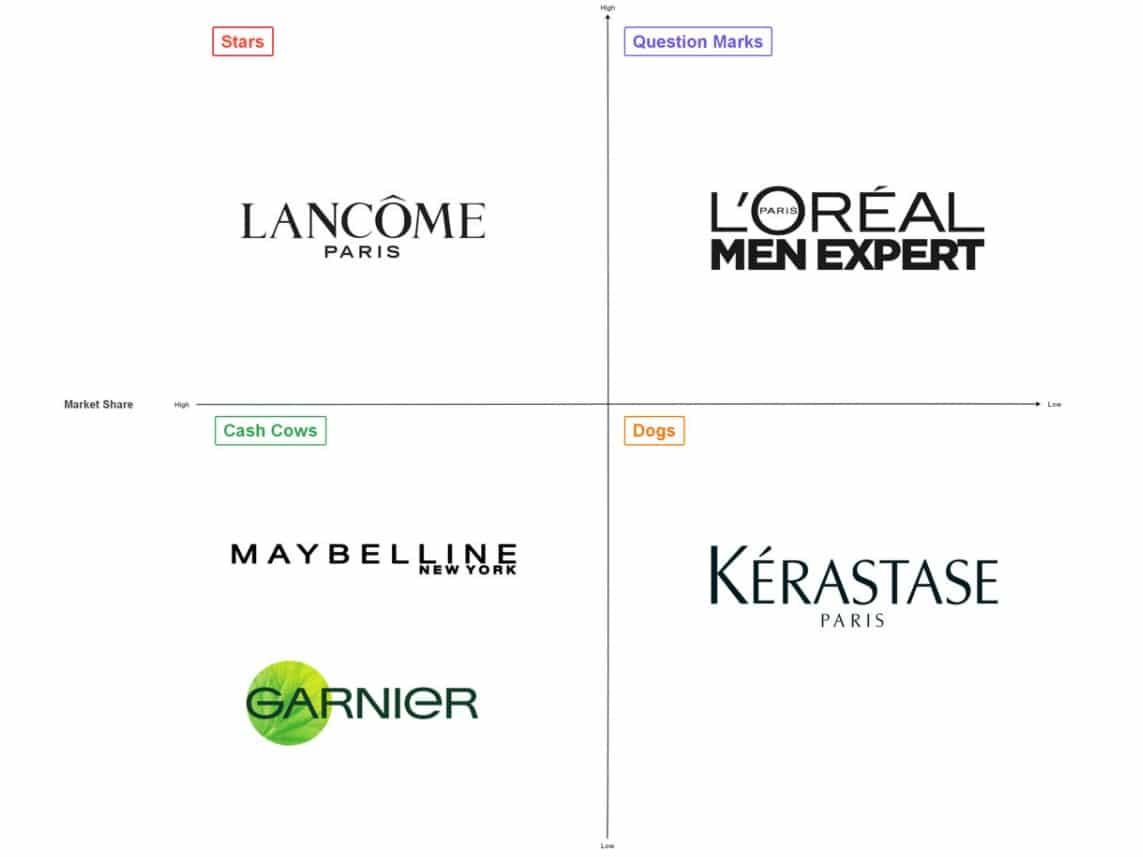

Let us take a company with several product lines operating in the market like L'oreal, Pepsico Inc. or Samsung. Now, consider you have to analyse which existing product lines are making profits for the organisation and which ones are making losses. The BCG growth-share matrix model will help you map these product portfolios and categorise them according to their market growth.

The BCG growth-share matrix model will help you understand how companies or organisations strategise their different businesses. It can help you analyse which brands a particular organisation should invest in and which brands can be divested.

What is the BCG growth-share matrix model?

The BCG growth-share matrix is a four-quadrant model based on two factors: relative market share and industry growth for categorising any brand's product portfolio. High relative market share yields high cash returns, while high industry growth aids in earning high revenue and profits.

The framework reveals the company’s competitiveness and market attractiveness for each product portfolio. A Company’s competitiveness is determined by the organisation's relative market share and profit margin. In contrast, market attractiveness is determined by market size and growth rate.

If put in simple words, the BCG growth-share matrix would help you decide the optimised cash flow for an organisation. Developed by the Boston Consulting Group (BCG), this matrix is also known as the product portfolio matrix.

What are the four components of the matrix?

The matrix categorises the products into four categories by keeping the x-axis as relative market share and the y-axis as industry growth. Let us look at the picture below to understand these four categories.

I will now explain these categories and how they behave in terms of relative market share and industry growth.

Cash Cows: Businesses with a high market share but low industry growth are termed 'cash cows.' The name 'cash cows' has been given as any organisation can get high profits from these brands with low investment. Since the industry is not growing anymore and has matured, there is no need to invest in innovation.

An excellent example of a 'cash cow' product would be coco-cola. As you know, the beverage industry is mature, and the company operates in more than 200 countries earning high revenue.

Dogs: The next product category is dog or pet. This product category has a low market share and a low growth in the industry. These brands are not advisable to invest in as they do not have the capacity of earning revenue for any organisation.

We can further understand this category by taking the example of diet-coke. It has a meagre market share and limited opportunity to grow as diet beverages have not captured customers' interest.

Stars: 'Star' products are the leading brands for any organisation. These products have a significant market share, bringing in the most money. The industry for this product also has a high growth potential hence earning more cash returns.

Let us look at the example of bottled-drinking water Kinley, where the industry is still growing, and the product category is also well-established, with a high market share. The company can further invest in this brand.

Example of BCG Growth-Share Matrix

Below is another example where I have tried to categorise the products of L'oreal in these four categories.

Source: https://www.edrawmind.com

How do you calculate market growth in BCG matrix?

Now that you have understood what is the growth-share matrix used for, let's learn how do you calculate market growth in BCG matrix for any given company.

- Choosing the product: To apply this matrix, the first step would be to select any particular organisation. In this case, let us take Samsung.

- Identifying the industries/markets: In the next step, you have to identify the different markets sectors this organisation sells its products. In the case of Samsung, they would be smartphones, tablets, laptops, printers, household appliances and smartwatches.

- Calculating Relative Market Share and finding industry growth: Once you have identified the different market sectors, we have to figure out the relative market share of each category for the organisation. You will also have to find how much growth potential each industry has.

- Placing the products on the matrix: Once the share is calculated, we must place the products accordingly.

Key Learnings

Suppose you ever need to simultaneously assess the growth potentials of different brands of a single company, you just have to follow this 4-step process and apply the BCG-growth share matrix.

Please note that when your products are affected by many other factors apart from relative market share and industry growth, this analysis needs to be supplemented by other studies. To learn how BCG matrix is relevant to digital marketing, please refer to https://www.superheuristics.com/bcg-matrix/.

We have, so far, analysed how a brand can get impacted by several internal and external factors and how depending on these factors, we have to finalise our product that is worthy of investment. The next step in the marketing strategy would be the process of Segmentation, Targeting and Positioning (STP) of the product. I have covered a framework for each of these processes in the next chapters.