I have spent the last two weeks working on an international expansion strategy for one of the products that I head at my workplace. Every multinational business was somewhere started as a local business and over the time has adopted different modes of entry into the international business.

Similarly, the company that I currently work for is trying to break into the middle-east with something that we are not sure of whether it will work well in there or not. In order to develop a plan of action for how I am going to take this further, I started with a really basic research – What are the various modes of entry into the international business?

When businesses grow successfully within their domestic markets, they attempt to expand their businesses into international markets, in an attempt to replicate its success in overseas markets.

Your business can opt for different modes of entry into international business based on the size of your business, your expansion strategies, the potential size, the demand of your chosen international market, the economic and the business environment of the overseas nation etc.

In this article, I will share with you what are the different modes of entry into international business. Having an idea of the different modes of entry into international business will give you a head start in creating a solid international strategy for you business.

Key Decisions Involved in Expanding Internationally

Deciding Whether to Go Abroad

You as a marketer or your company need to decide whether you want to expand internationally abroad or not. There are 5 main reasons why a company would want to expand internationally. I have mentioned those below when I discuss 'Why should companies expand internationally?'

Selecting the market(s) to enter

Before deciding on the entry modes into international business, the crucial part is deciding which markets to enter. This decision needs to be deliberated by you as the marketer by analyzing all the possible options and making the choice basis a suitable framework.

Finalizing the entry mode(s)

There are 5 modes of entry into international business that a business needs to choose from. This choice, like any other, is a trade off. Different entry strategies for international markets have different advantages and disadvantages. I will be discussing this below in 'What are the different modes of entry into international business?'

Preparing the marketing plan

Marketing needs to be personalized and culturally relevant. Often the market campaigns, product, promotion and pricing strategies that are a success in one country fail in another country. Therefore, you as a marketer need to understand the cultural fabric of the country you target and craft a marketing plan for it.

Marketing Concepts Mastery Course

Learn the essential marketing concepts and create the best outcomes from MBA without depending on placements!

You as a future business leader, need to solidify the basic concepts of marketing to be able to solve bigger and complex marketing problems. Learn these concepts differently, build a personal brand and sky-rocket your career.

Why should companies expand internationally?

A truly multinational company is one which has a globalized supply chain spread across different parts of the world. While a global supply chain has its own vulnerabilities, which are usually beyond the control of the company (for example: the Tsunami in Japan), there are many reasons why a company would want to enter into international markets.

The primary reasons that companies opt to expand into foreign markets are to:

1. Explore markets with better profitability

This is an obvious reason for a lot of local companies to enter into an international markets. An international market could have a higher purchasing power and, therefore, the same products can earn better profits in that market. This is obviously minus the initial go-to-market cost of breaking into that international market.

2. Achieve economies of scale with a larger customer base

Some goods and commodities provide the company with great economies of scale opportunities. The effects of economies of scale can be magnified when a larger base of customers come into the business. This is pretty relevant to tech-based companies who can be easily classified as 'born-global' companies. This companies can offer their technology products to a new customer, any where in the world, at no additional costs. Hence, making more money on the buck.

3. Reduce over dependence on any one market

Each business should be diversified across products and also across the market segments that it targets. This protects the business from uncertainties. This is another reason why a company should expand internationally. Usually, your job as a marketer would be the stabilize your product portfolio as well as customer portfolio to make your business robust against seasonality and these uncertainties.

4. Take global competitors head-on on their home turf

This is another why a company would want to go international. When you as a local company have successfully challenged a foreign company in the local market, you get the confidence to challenge the company in other similar markets as well.

5. Service customers who are abroad

There could be tech companies who already serve customers around the world despite being centered at only their home country. When the company has enough number of big ticket customers in some part of the world, they can think about setting up an office there and further expand their customer base. This is done better when the company serves the international market with personalized and culturally relevant market.

What are the Different Modes of Entry into International Business?

Some of the modes of entry into international business you can opt for include direct export, licensing, international agents and distributors, joint ventures, strategic alliance, and foreign direct investment.

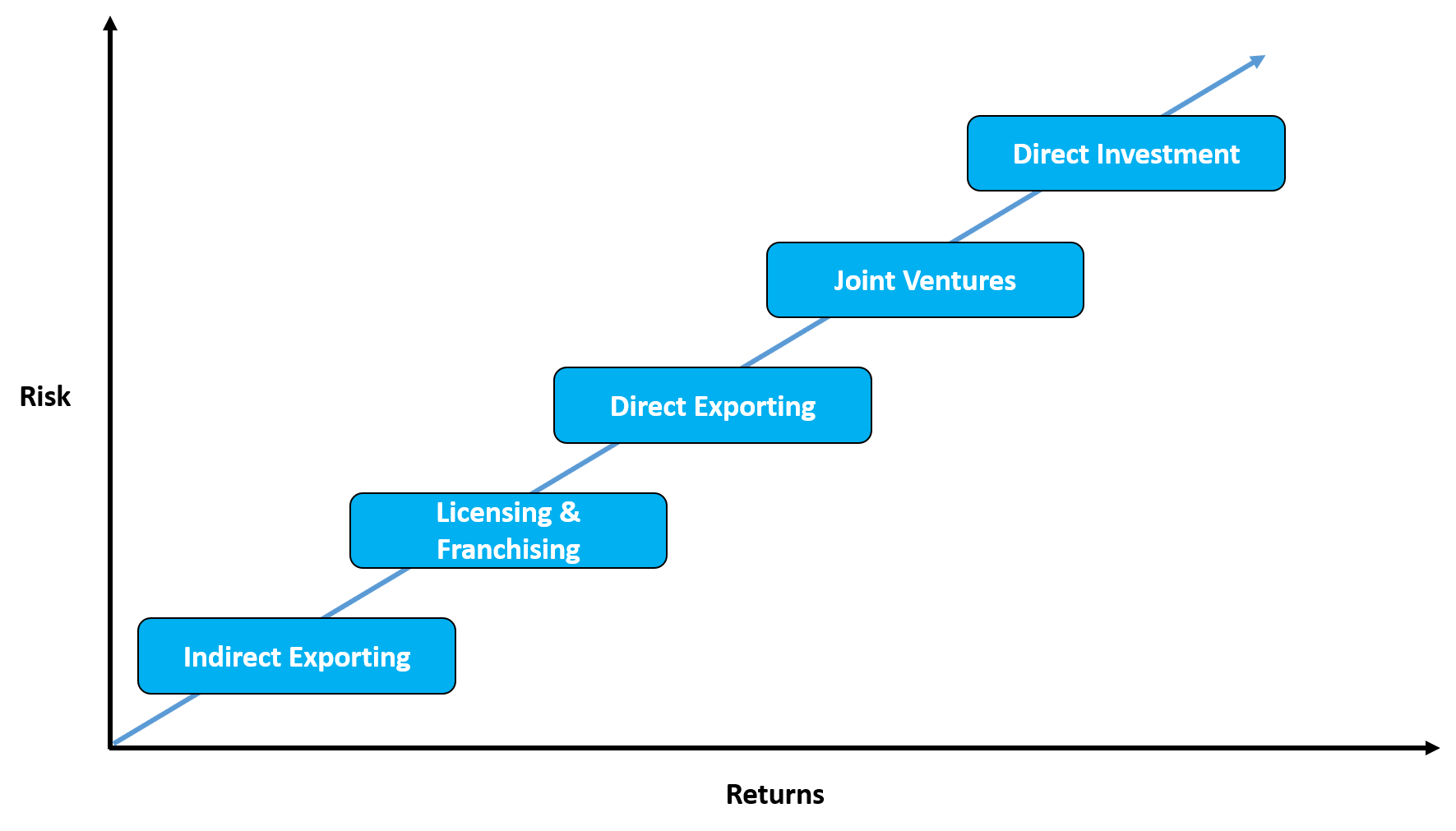

Each of these entry strategies for international markets are different in terms of the costs involved, level of risk, level of ease of execution, and the level of reward. I have arranged these 5 modes of entry into international business on a graph which suggests what are the trade-offs in each of these entry strategies for international markets.

I will put in my effort to explain to you what each of these entail for an offline product as well as for an online product based company. While the crux remains the same for both the types of businesses, how you carry out the strategy could have slight differences.

Let’s understand in detail what each of these modes of entry entail.

1. Direct Exporting

Direct exporting involves you directly exporting your goods and products to another overseas market. For some businesses, it is the fastest mode of entry into the international business.

Direct exporting, in this case, could also be understood as Direct Sales. This means you as a product owner in India go out, to say, the middle east with your own sales force to reach out to the customers.

In case you foresee a potential demand for your goods and products in an overseas market, you can opt to supply your goods to an importer instead of establishing your own retail presence in the overseas market.

Then you can market your brand and products directly or indirectly through your sales representatives or importing distributors.

And if you are in an online product based company, there is no importer in your value chain.

Advantages of Direct Exporting

Disadvantages of Direct Exporting

2. Licensing and Franchising

Companies which want to establish a retail presence in an overseas market with minimal risk, the licensing and franchising strategy allows another person or business assume the risk on behalf of the company.

In Licensing agreement and franchise, an overseas-based business will pay you a royalty or commission to use your brand name, manufacturing process, products, trademarks and other intellectual properties.

While the licensee or the franchisee assumes the risks and bears all losses, it shares a proportion of their revenues and profits you.

When does this work the best?

I explored this strategy in the case where one of the established companies of the other country already had a loyal audience with them.

At the same time, their product line had gaps which I was able to fill up. Therefore, just like two pieces of jigsaw, it made complete sense for them to carry my product.

How is this different from a Joint Venture, you would think? It is.

And in this case, I shall explain the little difference in the subsequent part of the article.

Advantages of Licensing and Franchising

Disadvantages of Licensing and Franchising

3. Joint Ventures

A joint venture is one of the preferred modes of entry into international business for businesses who do not mind sharing their brand, knowledge, and expertise.

Companies wishing to expand into overseas markets can form joint ventures with local businesses in the overseas location, wherein both joint venture partners share the rewards and risks associated with the business.

Both business entities share the investment, costs, profits and losses at the predetermined proportion.

This mode of entry into international business is suitable in countries wherein the governments do not allow one hundred per cent foreign ownership in certain industries.

For instance, foreign companies cannot have a 100 hundred per cent stake in broadcast content services, print media, multi-brand retailing, insurance, power exchange sectors and require to opt for a joint-venture route to enter the Indian market.

Here is what’s the difference between a Licensing/Franchisee kind of a setup and a Joint Venture.

The subtle nuance that I came across while recently creating a strategy was that a franchise setup would work well when you as a franchiser are a bigger brand in that particular product.

You could be big in your own country and not necessarily in the franchisee’s country.

In case of a Joint Venture, both the brands have a similar level of brand strength for that particular product. And therefore, they wish to explore that product in that international market together.

Advantages of Joint Venture

Disadvantages of Joint Venture

Case Analysis Blueprint Course

Solve similar business cases like a true marketing expert and design your own marketing career

Get to know how to analyze a marketing case study comprehensively in just 5 slides. Which means that the next time you need to analyze a marketing case or need to participate in a marketing case competition, you know exactly how to ace the case

4. Strategic Acquisitions

Strategic acquisition implies that your company acquires a controlling interest in an existing company in the overseas market.

This acquired company can be directly or indirectly involved in offering similar products or services in the overseas market.

You can retain the existing management of the newly acquired company to benefit from their expertise, knowledge and experience while having your team members positioned in the board of the company as well.

Advantages of Strategic Acquisitions

Disadvantages of Strategic Acquisitions

5. Foreign Direct Investment

Foreign Direct Investment involves a company entering an overseas market by making a substantial investment in the country. Some of the modes of entry into international business using the foreign direct investment strategy includes mergers and acquisitions, joint ventures and greenfield investments.

This strategy is viable when the demand or the size of the market, or the growth potential of the market in the substantially large to justify the investment.

Some of the reasons because of which companies opt for foreign direct investment strategy as the mode of entry into international business can include:

Restriction or import limits on certain goods and products.

Manufacturing locally can avoid import duties.

Companies can take advantage of low-cost labour, cheaper material.

Advantages of Foreign Direct Investment

Disadvantages of Foreign Direct Investment

Conclusion

While every business dreams of global domination within its industry, you need to plan its internationalization strategy based upon your finances, existing capabilities, the growth potential of the overseas market etc. before opting for different modes of entry into the international business.

In this article I discussed with you the 5 modes of entry into the international business which I discovered during my research of how to expand the business that I work for internationally.

I will be glad to hear from you.