In the previous post of the Rock Your Internship series, I discussed an extremely important point of discussion among students and new practitioners that what is the Difference between Market Research and Market Analysis. Further, I went ahead to discuss the two basic types of Primary Market Research Study methods. This gets me to this post where I share my two cents about How to do Secondary Market Research.

As an intern or a new recruit in an organization, chances are that your market research work would begin with an elaborate secondary research. Moreover, as an intern, it’s possible that all you have got to do is a secondary market research and might not even be expected to do an original primary research.

Because, frankly, companies seldom go for primary research. Even if they do, the entire job is outsourced to a market research organization and is unlikely to be done in-house. That market research organization does an end-to-end job of producing insights and results for the company.

Why do a Secondary Market Research?

Before I answer How to do Secondary Market Research, it is important to understand why are we doing it. With a data pool of the humongous size that the internet is, you are surely going to find extremely pertinent information online. Searching for data over the internet is definitely the fastest way to access information.

It brings with itself convenience of time and advantage of speed. Apart from that, these are the three things that, I feel, make secondary market research so crucial

1. It is cheap.

I wanted to use the word ‘economical’ but come on! We know that scraping data off the internet is dirt cheap unless you are accessing certainly paid resources.

2. Helps in cross-comparison with primary data.

Here the idea is that you conduct a secondary market research after you are done conducting the primary research and compare an cross-check your primary data with it.

3. Helps in designing the primary research.

This is got to be the most underutilized aspect of secondary research. Here I mean that, for example, you could utilize the government data to understand that for your particular market research you must only focus in the age group of 18 – 40. Hence, you will design your questionnaire accordingly.

This makes it all the more important to do your secondary research well in order to make it extremely insightful and useful in the business context. Also, you will have to be careful that while it is a secondary research, scrapped from the sources all across the internet, it should not come across as a generic, globally accepted story.

Here is a quick look at how you could make your secondary market research a useful tool for the businesses you are working with. A secondary market research could be based on two kinds of sources:

Internal Sources

When tasked with doing a market research, always start by asking your mentor for all the internal intelligence that there is on the subject. This becomes important to understand because

- It would help you understand the subject from the company’s perspective and about what is relevant to them

- It will give you a headstart as in which direction should you start searching for data

- You would come to know of the many important keywords and business terms that are important for the particular process or the business

- Lastly, it will give you an idea of what the company already knows and what all you must not sweat about during the research

What do these internal sources of data include?

The internal sources of data is a huge collection of data that has been generated or gathered by the business/company till now. As a matter of fact, your market research will also become an internal source of data for the company in the future. These sources include:

- Product description and concept notes of the product

- Internal analysis reports of product development

- Product presentations delivered to the leadership team

- Stock Analysis reports

- Retail data – sales data, loyalty card data etc.

- Business Analysts

- Sales Executives

Here I would stress upon the fact that internal sources need not only be the documents piled up with the company. The real internal intelligence comes from interacting with the people who are in the similar job of analyzing data or are well acquainted with the product.

Therefore, the last two points that I mentioned above of Business Analysts and Sales Executives will help you get some minute insights about the business, the products and the demands of the customers from the company.

External Sources

While internal sources of data put you in a good stead, it is the external sources that you are most concerned about. Each of the external sources of data that I describe below can have an individual post for itself (and it most likely will have).

Let’s take a quick look at the most common and uncommon external sources of data that you can tap into. I have also included some of the tactics that I utilize to complete my secondary research.

1. Google Search

Can enough even be said about Google Search? No. There is so much you can do just with a Google Search that it is remarkable.

There are particular ways and methods through which you can extract more from Google search than you are doing right now. This infographic done by Mashable describes all of it perfectly. Make sure that you utilize the Google search completely in order to extract data that you might not get usually.

2. Documents prepared by competitors

What could serve a more dual purpose than this? Searching for white papers developed by your competitors would give you the correct picture of how it is done in the industry. This would tell you what problems have already been cracked by your contemporaries and what other areas are open for further research.

3. References mentioned in other documents

Feed off the hours that others have put in research for their work. The many white papers and research papers that you will come across during your preliminary Google search will definitely comprise a bibliography.

I see the bibliography as an opportunity to dig deeper. At times, the links and sources mentioned in the references will give you more in-depth knowledge of a particular aspect that might be mentioned in that research paper.

So the next time you like a topic that a researcher has brushed upon but hasn’t dug deeper, you know where to find more knowledge on it – in the references.

4. Paid and Free Research Reports

I can assure you that this would be one of the most ignored and under-utilized methods. While you do get hold of the various research reports that have been made available for free, you often long for those elaborate paid reports.

The most qualified information is in the detailed paid research reports that cost around $3000 to $5000 per report. And with a little extra effort, you may be able to actually get hold of the report.

Here’s an example of what I did during one of my internships at a business process outsourcing company:

I was tasked with a preliminary project of doing a market analysis and competitor analysis for one of the AI products they were building. The product serves a niche and trust me there was little data available for it online.

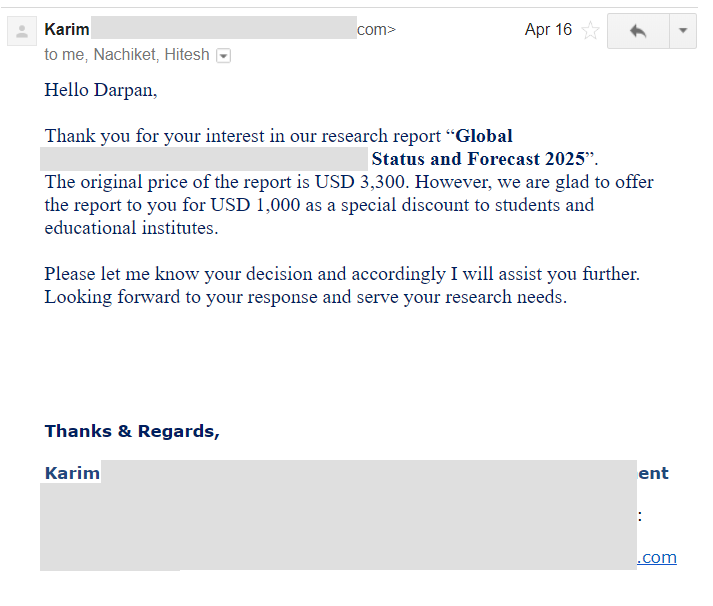

I came across a fairly detailed report on exactly that product’s niche. And let me tell you this was available with an extremely renowned research organization and cost $3300.

I immediately got down to my college email id, which has an @college-name.ac.in suffix and shot of a mail to the support team at the research organization.

I wrote about how I am a student willing to do a research on that niche topic and how their report is an interesting one. I enquire that considering that I am a student, will they be willing to share the report at a discount.

I never mentioned that I am currently interning at an organization and I require this report to submit my analysis to them. That is to be avoided.

In a couple of weeks, the research firm wrote back to me offering a 70% discount (which is outrageously high!)

Here’s what they wrote back to me:

A 70% discount was a big one. While the $1000 for which they were offering me this report was still beyond my limits, I made sure that I utilize this opportunity well at my internship.

I forwarded that mail to my manager about how I had applied for a discount through my email id and how they have agreed to offer it at much lower.

And guess what? They bought that report at $1000. I was appreciated for finding out this report and then initiating a conversation with them to grab this discount.

Moral of the story: Be sure to utilize this opportunity as long you have your college email id!

The list doesn’t end here. There are numerous other external sources of data that you are probably already using.

My intention over here was to point out a few of them that go a long way in building a really insightful secondary research for your projects. I hope your quest to find out how to do secondary market research sort of ends here.

In one of the upcoming articles, I will be covering some really interesting tools that you can use to execute your secondary research. Make sure that you’ve read my post on Primary Research Study.

Also, watch out for my Market Research Template coming out really soon.